Abstract

About eight years ago, a pseudonymous cryptographer known as Satoshi Nakamoto introduced Bitcoin as a digital analog to gold: limited in supply, but secured by modern cryptography, and made for the internet age. Following in Satoshi’s footsteps, many tried to improve his original vision and thousands of alternative cryptocurrencies were born.

Despite significant recent developments and innovation, the market for cryptocurrencies remains somewhat niche. Cryptocurrencies have shortcomings that currently discourage mainstream use, in particular, high volatility and barriers to entry and exit. OneGram aims to solve these issues by creating a business ecosystem to solve the entry and exit issues. Backing each coin/token with one gram of gold at launch to address the volatility issues and use blockchain technology to solve any outstanding problems. In short create a unique cryptocurrency.

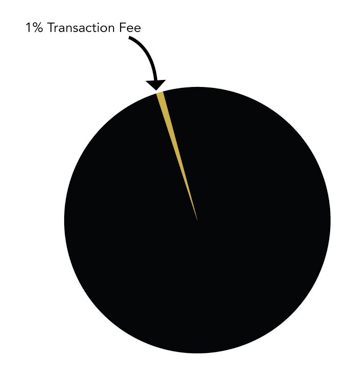

In addition, each transaction of the OneGram coin/token (OGC) generates a small transaction fee (1%) which is reinvested to purchase more gold (net of admin costs), thus increasing the amount of gold that backs each OneGram coin/token (OGC). Therefore, each OGC increases in real value over time. This alone makes OneGram unique not only among cryptocurrencies, but all other currencies worldwide.

Cryptocurrencies

Bitcoin and alternative cryptocurrencies are starting to see widespread adoption. The innovation behind cryptocurrencies is that, instead of relying on a trusted third party, transactions are recorded and propagated in a distributed ledger known as a “blockchain.” This allows transactions to be trustless, censorship-resistant, permission-less and private. Once a transaction is confirmed by the blockchain network it becomes irreversible. It can’t be charged back through a dispute process like other forms of money transfer.

Cryptocurrencies promise to radically change how we do banking by removing artificial barriers caused by legacy financial institutions and allowing for:

- True peer-to-peer payments anywhere in the world.

- Minimal transaction fees and processing time compared to traditional banking.

- Payments between pseudonymous parties ensuring financial privacy.

- Non-reversible transactions preventing charge-backs and fraud.

History of Money

Historically paper money as we know it stemmed from receipts issued for gold (or silver) stored in a vault, thus was either created from, or backed by precious metals. Worldwide bestselling author & internationally renowned expert on the history of money, Mike Maloney in his book Guide to Investing in Gold & Silver: Protect your Financial Future1 defines money as:

- Money is medium of exchange.

- Money is a unit of account.

- Money is durable and does not spoil or corrode.

- Money is portable.

- Money is divisible

- Money is fungible (each unit is interchangeable)

- Money is a true store of value over time

Unfortunately because countries no longer back their currencies with commodities anymore the pounds sterling (£) and dollars ($) we know as money today, are in fact just currency. Since the United States cancelled the convertibility of the United States dollar (US$) to gold with the “Nixon Shock” in the 70s2, national currencies have had freely floating exchange rates. These rates have been mainly dictated by central banks’ monetary policies3.

Fiat currencies are indeed abundant and widely available within the jurisdictions where they are accepted. Modern paper money and coins, along with their digital counterpart, are durable enough however fiat money can no longer claim to have any intrinsic value. Their perceived value is all based on faith. A faith that is generated by the respective government backing and nothing more.

So what about cryptocurrencies like Bitcoin? While Bitcoin and many other cryptocurrencies are much closer to the above definition of money (than modern fiat currency); they still fall short, as they too are not backed by any tangible real assets proven to keep their value over time.

Each OneGram coin/token (OGC) is unique because it is backed by a minimum of one gram of gold. OneGram is abundant and when the tokens go on sale at the Initial Coin Offering (ICO) in May 2017, there will be 12,400,786 tokens. All of them will be available for purchase through our partner GoldGuard, an online gold trading platform that enables customers to buy and sell gold at spot rates and physically store it. After the coin launch, anyone will be able to buy and sell OneGram (OGC) freely through many international channels. OGCs are durable and can be kept safely in your cryptographically secure wallet. OneGram has a unique intrinsic value because it’s backed by physical gold.

The OneGram ecosystem will offer merchant applications (apps) and payment processing services, making OneGram a convenient medium of exchange across the world.

Limited Downside Unlimited Upside

The history of fiat currency is a history of volatility. The average lifespan of a fiat currency is only twenty-seven (27) years4. Even if a currency survives longer, invariably it will experience increasing inflation. This steadily erodes the purchasing ability of fiat money over time. The world’s oldest fiat currency, the British pound (£), is an excellent example; it has lost ninety-nine and a half percent (99.5%) of its value since inception.

Historically gold is more resilient, and holds it’s value better than any fiat currency and is particularly strong in times of economic instability.

No currency can guarantee absolute stability, but OneGram limits your exposure to downside risk. Since the base price of a OneGram coin/token (GGC) is always at least equal to the spot price of gold, it has a floor price. Usage and market demand also adds a premium to the value of OneGram which therefore has a three-part valuation system to determine its overall market price.

- The first part is the gold value (GV), with the value being determined by the spot price of gold.

- The second part is the present value of the transaction fees reinvested to buy more gold (TF), with that value being determined by the usage of the OGC coin/token.

- Thirdly is the economic value (EV), with that value being determined by market demand. This creates the following formula for the market price: OneGram coin/token (OGC) value = GV + EV

Growth With Every Transaction

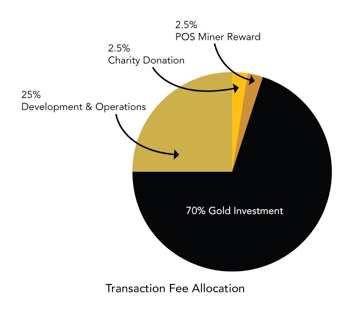

Each OneGram transaction generates a one percent (1%) transaction fee, up to a maximum of one (1) OGC token. Unlike other cryptocurrencies, with OneGram seventy percent (70%) of this fee is reinvested to buy more gold to increase the amount of gold that backs each token. As transaction volumes increase, more gold is added to the vault and all OneGram coin/token (OGC) owners share in the profit by an uplift in the value of each unit. Over time, the value of each OneGram token rises by default. This makes OneGram a unique asset and a consistent store of wealth whose value increases perpetually. Twenty-five percent (25%) of this fee will be used for development & Operations. Two and a half percent (2.5%) will be donated to charities and two and a half percent (2.5%) will reward miners (POS staking).

Historically gold is more resilient, and holds it’s value better than any fiat currency and is particularly strong in times of economic instability.

The transaction volume for a new cryptocurrency is typically low. To address this, we will be introducing a variety of strategies for rapid real-world adoption of OneGram as a currency.

OneGram coins are issued and redeemed for gold via the the GoldGuard platform. After coin launch, the OGCs can be bought, sold and traded via any major cryptocurrency trading platform.

A new payment gateway, YalaPay, will be launched for OneGram coins. Besides fiat conversion, YalaPay will include marketing strategies such as a white label loyalty program for merchants, featuring special offers, and discounts for customers. The model will be first introduced in Dubai and Abu Dhabi, with the payment institution license already in place.

A GoldGuard Mastercard debit card (“Liquid Gold”) will also be created, which will work across the globe in ATMs, POS systems and online. It will be possible to recharge the Liquid Gold card with fiat, OGC or gold through our payment gateway, online or through GoldGuard ATM machines.

By giving token holders all the best in the financial services offered by cryptocurrencies, OneGram aims to make transactions numerous and easy for the users.

Technical Specifications

Blockchain technology enables a decentralized, anonymous, deregulated, efficient and affordable cryptocurrency transfer. The reference implementation of the OneGram blockchain is written in C++ to achieve maximum efficiency and performance, as well as multiplatform compatibility (Windows, Mac OS, Linux, BSD). Specific technical parameters of blockchain based on Graphene provide space for sufficient configuration variability to allow the upper layer of the blockchain to adapt to the requirements of the business application.

Smooth Entry and Exit with GoldGuard

Buying and selling cryptocurrencies like Bitcoin is not always an easy task. Depending on where you live, there may be no obvious entry and exit points. Mining cryptocurrencies is even more difficult, requires costly equipment, and is definitely not an option for the average user.

Once a OneGram coin/token (OGC) is issued, it can be redeemed for physical gold from GoldGuard at any time. Any OneGram coin redeemed for gold or the equivalent in fiat currency is sent to a publicly verifiable burn address, permanently removing the coin from circulation.

GoldGuard is licensed (license Number: 3287) with Dubai Airport Free Zone (DAFZ) to trade jewelry, namely gold. DAFZ is one of the fastest growing Free Zones in the Middle East. It was established in 1996 within the boundaries of Dubai International Airport,

While GoldGuard has a license to operate in Dubai, the gold we purchase is safeguarded by logistics and transportation experts from our gold suppliers/storage providers located in Dubai and Singapore.

All accounts at GoldGuard are asset-backed on an annual basis. They are also insured against theft and damage.

Giving Back to the Community

Giving back to the community and setting a good example is central to how we do business. We seek to contribute to social and economic progress both globally and locally.

With that in mind, we created the OneGram Foundation (OGF). OGF will take two and a half percent (2.5%) of the total transaction fees that OneGram products generate and donate it to local and international charities.

By sharing our success, we aim to bring benefit to the lives of those less fortunate. The OneGram community will contribute, through corporate and social responsibility to humanitarian causes.

References

1Guide To Investing in Gold & Silver: Protect Your Financial Future by Michael Maloney (Wealth Cycle Press) released15-09- 2015

2Kollen Ghizoni, Sandra. “Nixon Ends Convertibility of U.S. Dollars to Gold and Announces Wage/Price Controls”. Federal Reserve History.

3Sachs, Jeffrey D., Larrain, Felipe. Macroeconomics for Global Economies. Prentice-Hall.

4Pento, Michael G. The Coming Bond Market Collapse: How to Survive the Demise of the U.S. Debt Market. John Wiley & Sons.